Nigerian equities traded yesterday with an underlying risk-off sentiment as investors remained cautious of returns outlook at the stock market.

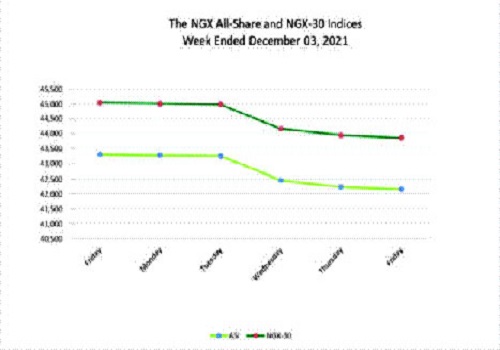

Benchmark indices at the Nigerian Exchange (NGX) closed yesterday with average decline of 0.08 per cent, equivalent to net capital depreciation of N19 billion.

The All Share Index (ASI)- the value-based common index that tracks all share prices at the Exchange dropped from its opening index of 44,046.94 points to close at 44,011.22 points. Aggregate market value of all quoted equities also dropped from its opening value of N23.991 trillion to close at N23.972 trillion.

With nearly two decliners for every advancer, the negative overall market position was driven by widespread selloffs across the sectors. There were 21 losers against 13 gainers. Unilever Nigeria led the gainers with a gain of 10 per cent to close at N11 per share. Stanbic IBTC Holdings followed with a gain 9.09 per cent to close at N30. University Press rose by 8.93 per cent to close at N1.83. Sovereign Trust Insurance appreciated by 8.33 per cent to close at 26 kobo while Royal Exchange gained 6.85 per cent to close at 78 kobo per share.

On the negative side, Guinness Nigeria led with a drop of 9.97 per cent to close at N60.50 per share. SCOA Nigeria followed with a drop of 9.79 per cent to close at N1.29. Associated Bus Company dipped by 8.0 per cent to close at 23 kobo per share. United Capital lost 5.83 per cent to close at N11.30 while Oando dropped by 5.76 per cent to close at N3.60 per share.

The momentum of activities also dropped considerably as total turnover fell by 38.7 per cent to 97.699 million shares worth N847.882 million in 2,980 deals. Transnational Corporation of Nigeria (Transcorp) topped the activity chart with 10.655 million shares valued at N11.583 million. Access Holdings followed with 8.093 million shares worth N68.743 million. Sterling Bank traded 7.415 million shares valued at N10.432 million. Guaranty Trust Holding Company (GTCO) recorded a turnover of 6.997 million shares valued at N134.003 million while Nigerian Aviation Handling Company (NAHCO) recorded 6.995 million shares worth N37.717 million.

“The consolidation of the market just above 44,000 levels signifies tepid market momentum. A subsequent close above this level may be a confirmation of this level. However, if the market fails to hold above 44,000, it may be a confirmation of its resistance level’s strength; as it may struggle to regain this level.

“Investors should pay close attention to global indicators as well as trends under the current global situation. We would like to reiterate that investors should go for stocks with good fundamentals with regards to their portfolio,” analysts at Arthur Steven Asset Management stated at the end of the trading.

Analysts at Afrinvest Securities said they expected that “the bearish performance would be sustained in the absence of any positive catalyst”.